This also helps investors more accurately assess the business’s financial health. A Fiscal Year (FY), also known as a budget year, is a period of time used by the government and businesses for accounting purposes to formulate annual financial Fiscal Year And Fiscal Period statements and reports. A fiscal year consists of 12 months or 52 weeks and might not end on December 31. A fiscal year covers a consecutive period of twelve months and is used for calculating and preparing financial statements for the year.

More detailed definitions can be found in accounting textbooks or from an accounting professional. For instance, a fiscal year that runs from April 1, 2023 to March 31, 2024 is called FY24. Companies that can use fiscal years which don’t coincide with calendar years can break their year up as they see fit to align with their industry. In Afghanistan, from 2011 to 2021, the fiscal year began on 1 Hamal (20th or 21 March).[10] The fiscal year aligned with the Persian or Solar Hijri calendar used in Afghanistan at the time.

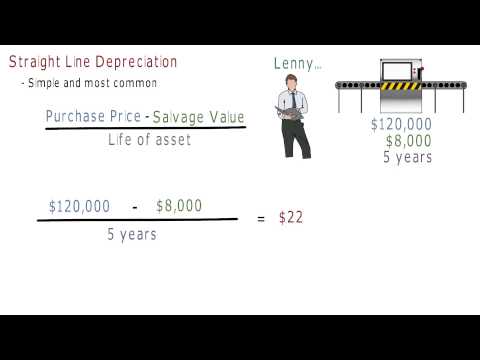

Financial Basics

While both periods last for 365 days or twelve months, the start and end dates will vary. In this article, we’ll take a closer look at the definition of fiscal and calendar year, as well as key differences between them. The default IRS system is based on the calendar year, so fiscal-year taxpayers have to make some adjustments to the deadlines for filing certain forms and making payments. While most taxpayers must file by April 15 following the year for which they are filing, fiscal-year taxpayers must file by the 15th day of the fourth month following the end of their fiscal year. For example, a business observing a fiscal year from June 1 to May 31 must submit its tax return by Sept. 15.

- Apple Inc. (AAPL) ends its fiscal year on the last Saturday of September; in 2020, this fell on the 26th.

- Following period 12, there are two additional periods included in a fiscal year.

- A fiscal year may be referred to as a budget year or natural business year because it ends when sales or other activities are at a natural low point.

- Virgin Islands.[67] Puerto Rico is the exception, with its fiscal year ending on 30 June.

- For example, Standard Chartered’s IDR follows the UK calendar despite being listed in India.

Companies following Indian fiscal year get to know their economic health on 31 March of every Indian financial or fiscal year. However, a company incorporated in Hong Kong can determine its own financial year-end, which may be different from the government fiscal year. Period 13 is reserved for Central Accounting to process transactions in preparation for reporting to the University of California, Office of the President. For the campus at large, all closing activities should be completed before the end of Period 12.

IRS Requirements for Fiscal Years

There are benefits to both systems, so you’ll need to think about your business’s own patterns and accounting needs. Seasonal businesses often benefit from using a fiscal year that gives wider flexibility to tax reporting and liability. Yet for subscription businesses with steady revenue throughout the year, a calendar year might be the better option. You must file IRS Form 1128, Application To Adopt, Change or Retain a Tax Year, if you want to change from one type of reporting year to the other. You are not required to pay a user fee if your request is automatically approved. You do have to pay a fee and request a ruling on behalf of your business if you are ineligible for automatic approval.

- The start and end dates of a fiscal year will depend on the country a company does business in.

- In some cases, large companies use a factor to trade accounts receivable for immediate cash.

- If you are using a factoring company that purchases your receivables during the fiscal year, you may want to check the tax implications while you sold your accounts receivable.

- Or they can designate an alternate fiscal year that best suits their accounting needs, such as one that closes after an expected increase in revenue.

- This is because often budgeting planning from the government will be disclosed and new projects finalized.

- Below are 10-K reports from popular companies with fiscal years that don’t follow the calendar.

The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis. Every 12 months, companies are required to report their income and expenses to the government to calculate and pay their taxes.

Fiscal Year and Fiscal Periods

The IRS allows companies to file as either calendar-year or fiscal-year taxpayers, provided that the records are kept consistent from year to year. For smaller businesses that might not keep detailed records, the IRS requires the use of calendar year reporting. One https://kelleysbookkeeping.com/how-to-enter-a-credit-memo-in-quickbooks/ thing to note is that the IRS uses the calendar year as its own default system, meaning fiscal-year filers must adjust deadlines to make payments and file required forms. For example, those using the calendar year system would file by the usual April 15 deadline.

Endava Announces Third Quarter Fiscal Year 2023 Results – Yahoo Finance

Endava Announces Third Quarter Fiscal Year 2023 Results.

Posted: Tue, 23 May 2023 11:19:00 GMT [source]

Partnerships, limited liability companies, and S corporations can use a fiscal year that is not a calendar year, as long as it meets the IRS definition of a tax year and it has approval to do so. Among the inhabited territories of the United States, most align with the federal fiscal year, ending on 30 September. Virgin Islands.[67] Puerto Rico is the exception, with its fiscal year ending on 30 June. Companies following the Indian Depositary Receipt (IDR) are given freedom to choose their financial year. For example, Standard Chartered’s IDR follows the UK calendar despite being listed in India.